rhode island state tax rate

The most recent information on Rhode Islands income tax rates. Here you can find how your Rhode Island based income is taxed at different rates within the given tax brackets.

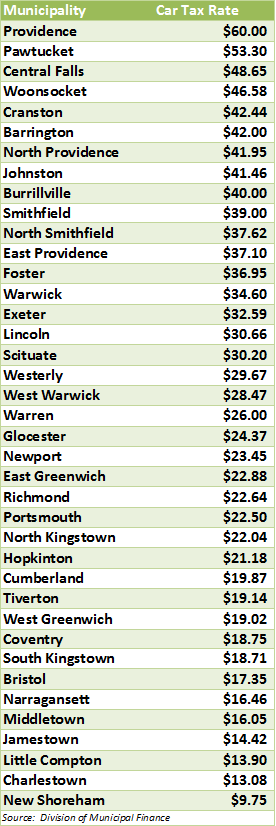

Lists Rhode Island Property Tax Rates

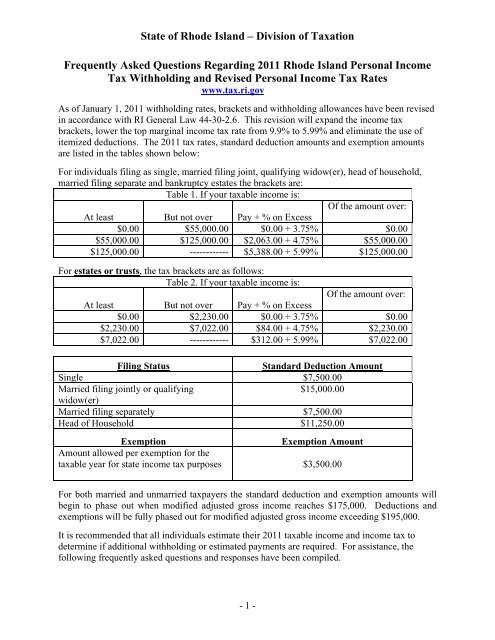

The income tax is progressive tax with rates ranging from 375 up to.

. Rhode Islands tax rate is one of the highest in the country. 3 rows Tax rate of 475 on taxable income between 68201 and 155050. To calculate the Rhode Island taxable income the statute starts with Federal taxable income.

RI-1040 line 7 or Enter here and on RI-1040NR line 7 is. Taxable income begins at 0 and rises to 66200 per year as a. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Note that any sale. 2022 Child Tax Rebate Program. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income.

State of Rhode Island Division of Municipal Finance Department of Revenue. Overall Rhode Island Tax Picture. Tax rate of 599 on.

The state now collects taxes from its residents at the following rates 2014 tax year inflation adjustments. Rhode Island has a. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

The rate threshold is the point at which the marginal estate tax rate kicks in. 39 rows Rhode Island Towns with the Highest Property Tax Rates. Groceries clothing and prescription drugs.

However the average effective property tax rate is 163 which is more than the average US. Marginal tax rate 475. Sales Use Tax.

Rhode Island State Married Filing Jointly Filer Tax Rates Thresholds and Settings. Exact tax amount may vary for different items. Rhode Island income taxes are in line with the national.

Income Tax Brackets Rates Income Ranges and Estimated Taxes Due. In Rhode Island the median property tax rate is 1571 per 100000 of assessed home value. RI-1040 line 8 or Over But not over RI-1040NR line 8 0 66200 150550 Over Page T-1 66200 150550 375 b Multiplication.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per. For the 2022 tax year homeowners 65 and older. Rhode Island Real Property Taxes.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. If you make 120000 a year living in the region of Rhode Island USA you will be taxed 26200. Rhode Island property taxes vary by county.

Effective property tax rate of. 2022 Child Tax Rebate Program. Rhode Island State Personal Income Tax Rates and Thresholds in 2022.

The income tax overhaul has made Rhode Island competitive with other New England states by lowering its maximum tax rate to 599 and reducing the number of tax brackets to three. Rhode Island state. The table below shows the income tax rates in Rhode Island for all filing statuses.

The law provides generally for a tax on the sales at retail of tangible personal property certain public utility services and curtained enumerated services. Providence has a property tax rate. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

375 on the first 60550 of taxable income. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per.

About Toggle child menu. Rhode Island also has a 700 percent corporate income tax rate. Effective tax rate 385.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Rhode Island State Tax Tables 2021 Us Icalculator

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Newport Councilors Target Higher Property Taxes For Short Term Rental Homeowners

Golocalprov The Highest Car Taxes In Rhode Island

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Top States For Business 2022 Rhode Island

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Sales Taxes In The United States Wikiwand

Rhodeislandtax Rhodeislandtax Twitter

Tobacco Use In Rhode Island 2020

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Rhode Island State Veteran Benefits Military Com

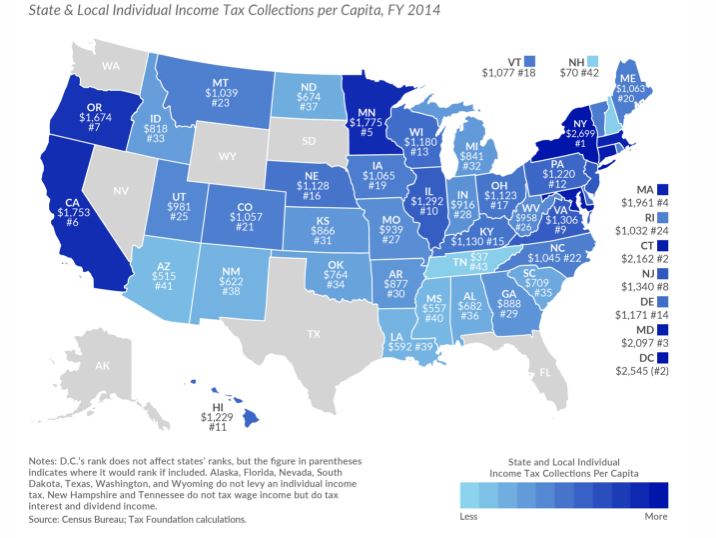

R I State And Local Income Tax Per Capita 2nd Lowest In New England

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Map Of Rhode Island Property Tax Rates For All Towns

Ri Kpi Briefing For Q2 2022 Rhode Island Experiences Employment Gains But Still Lags Nation In Recovery Of Jobs Lost During Pandemic Rhode Island Public Expenditure Council